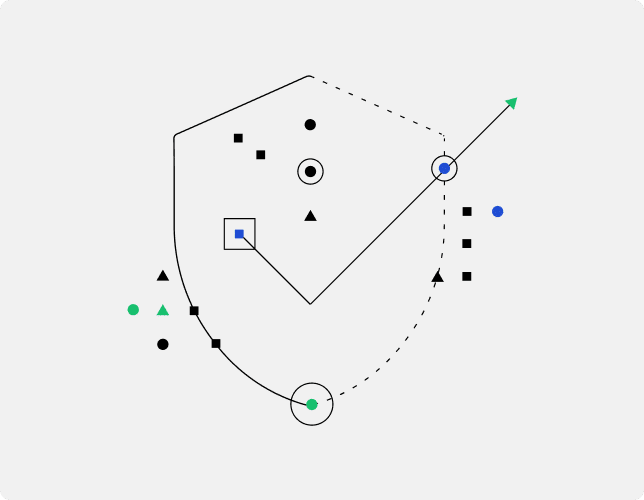

Securely collaborate across institutions, business lines, and borders to better detect, prevent, and investigate fraud.

Mastercard successfully uses Duality’s Privacy Protected Data Collaboration Platform to maintain compliance while exchanging sensitive information across jurisdictions (US, UK, India, Singapore).

A typical financial institution may only see 15%-25% of their own customers’ activity. Secure, compliant, and privacy-protected information sharing can provide organizations with a complete view of customer activity, enabling them to more effectively disrupt cybercrimes and fraud while keeping their customers safe and preserving a competitive edge.

Share and compare account, device, customer information, and more with your peers to better detect, investigate, and prevent fraud.

Collaborate across carriers to combat fraudulent and duplicate claims, identify fraud rings, and drive investigations.

Identify indicators of compromise, prevent attacks, and share whitelists and blacklists.

Duality’s privacy-preserving collaboration platform enables fraud teams to securely share information, enabling them to better detect and prevent fraud while staying competitive.

Duality enables teams to collaborate across company and national borders without exposing sensitive personal or commercial information. By eliminating cumbersome manual processes, Duality introduces a new level of effectiveness in financial crime detection, prevention, and investigation.

“We partnered with Duality to fulfill the promise of privacy preservation in information sharing. The Duality platform has the potential to become one of the key tools for inter-bank collaborations.”

Receive answers to questions on accounts, entities, and transactions without waiting.

Collaborate with peer banks to get deeper insights without revealing sensitive information.

Prevent fraud losses by using data to make better decisions across the customer lifecycle.

Mitigate risk and liability by protecting data with quantum-resistant encryption.

Effectively fight financial crimes while complying with financial and privacy regulations (including CCPA, GDPR, and PIPEDA).

With Duality, you can now share and compare account, device, customer information, and more with your peers while protecting privacy. Remain competitive and compliant while exchanging encrypted information on:

Account, device, and PII information changes

Known or suspected criminals and mule accounts

Victims of fraud, identity theft, and data breaches

Suspicious IP addresses, email addresses, and phone numbers

Synthetic identity information and indicators

Maximize the value of sensitive, regulated, or confidential data.