News

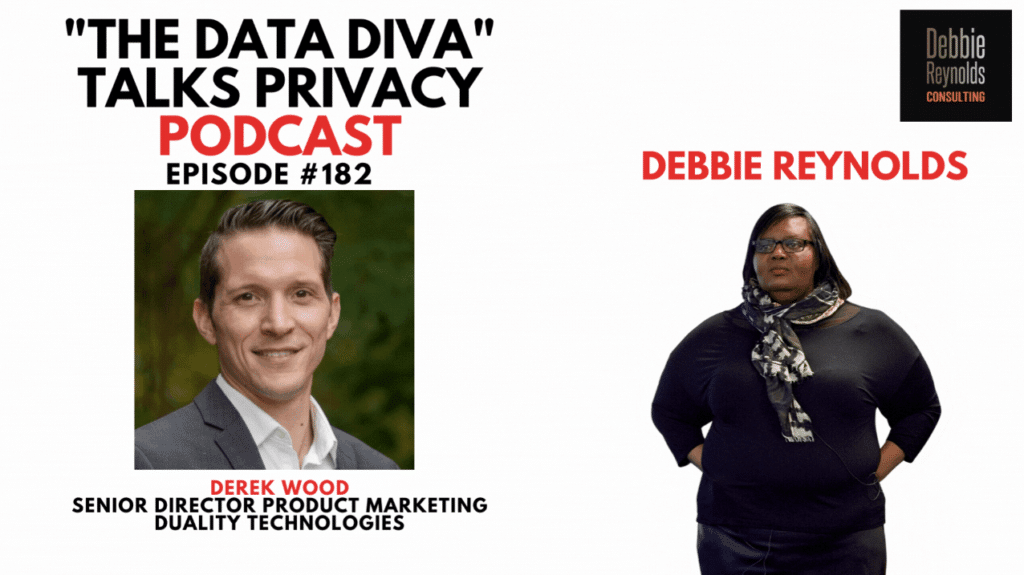

PODCAST: Data Diva Talks Privacy #182 – The Privacy Imperative and Privacy Solutions

In episode 182 of “The Data Diva” Talks Privacy Podcast, Debbie Reynolds talks to Derek Wood Senior Director of Product Marketing at Duality Technologies. We discuss the challenges of data privacy and the balance between using data for business purposes while respecting individuals’ rights. We stress the importance of managing data in a way that doesn’t hinder business operations but also upholds privacy standards. We explore the evolving landscape of privacy and security, emphasizing the regulatory push for privacy-enhancing technology and the convergence of privacy, security, and governance within organizations. The conversation also focused on developing a workflow that addresses these challenges, providing a solution that allows effective protection of both the model and input data, presenting a significant opportunity for growth in the current landscape. We discuss the potential risks associated with Generative AI and voice spoofing. We emphasize the need for increased awareness and potential solutions to address the risks posed by generative AI and voice spoofing. Additionally, we explore the complexities of tracking data from its origin to various copies and usages, highlighting the difficulties in maintaining documented data lineage. The conversation underscored the need for organizations to adopt privacy-enhancing technologies to ensure data transparency and security. We discuss the shifting landscape of data sharing, its implications for third-party relationships, and the challenges third-party companies face in meeting increasingly stringent data security requirements, which can potentially hinder their ability to collaborate with first-party data companies. The discussion emphasizes the need for innovative solutions to alleviate risk for both parties and facilitate smoother data-sharing processes. Additionally, we underscore the role of technology solutions in enabling efficient and secure data management to meet the demands of the evolving business environment and his hope for Data Privacy in the future.