AI-driven agents improve customer experience and sales efficiency, while privacy-enhancing technologies enable secure usage of sensitive data. These advancements allow insurers to scale AI adoption while ensuring compliance and data security.

the problem

Customers expect real-time, personalized service, but traditional customer support methods are resource-intensive and lack efficiency. Insurers face challenges in adopting AI-driven automation because AI agents require access to sensitive customer and policy data, which increases the risk of data breaches. Strict regulations further limit data sharing, making it difficult to deploy AI models effectively across different business functions. Achieving scalable AI adoption without compromising data protection is crucial for modern insurers.

the solution

Privacy-preserving AI agents enhance customer interactions while ensuring data security. AI-powered chatbots provide real-time, secure, and personalized responses, reducing reliance on human agents. AI adoption strategies accelerate innovation while maintaining trust and regulatory compliance.

“The need for actionable big data insights has never been greater. With 3rd Gen Intel Xeon processors, Duality […] applications can simultaneously address privacy, security, confidentiality and scalability challenges in a manner which can benefit organizations across many industries.”

Providing real-time assistance for customer inquiries and claims status updates.

Enhancing lead scoring and personalized policy recommendations.

Implementing privacy-first AI solutions across different business units.

Real-time, AI-driven interactions enhance satisfaction.

Secure deployment accelerates AI implementation across insurance functions.

Reducing reliance on manual operations while ensuring compliance.

Data sharing across borders presents significant challenges for insurance agencies, especially when handling sensitive health and claims information.

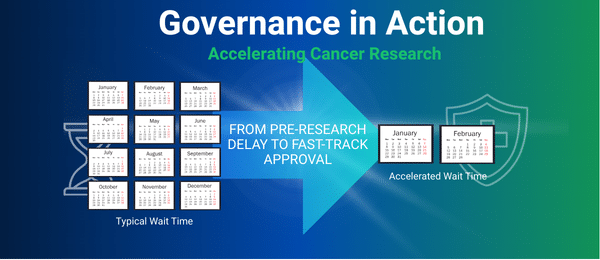

Duality Technologies helps insurers securely collaborate internationally by enabling analytics across jurisdictions without compromising policyholder confidentiality or regulatory compliance.

Our advanced data collaboration platform leverages high-performance computing, AI, and machine learning, allowing insurance companies to gain deeper insights, manage risk effectively, and drive innovation—while ensuring sensitive data remains protected.