The digital transformation is reshaping every industry of the world. This holds especially true for the banking sector where data analytics – the process of extracting, interpreting, and implementing valuable insights from vast volumes of data – has become a huge part of everyday business.

From its initial use in basic financial reporting to its current application in advanced decision-making processes, analytics has completely changed the way banks operate.

Banks have always collected vast amounts of data across various departments, but recently have discovered that bringing this data together can reveal its full potential. It’s not just about understanding customer needs, it’s about using this data for something even more crucial: making a profit.

What are Advanced Analytics?

Advanced analytics are tools that turn massive data sets into patterns, correlations, and insights that would be near impossible to find manually. This is where predictive models, driven by machine learning algorithms, data mining, and artificial intelligence (AI), come into the equation. Banks have a wealth of data at their fingertips, but it’s only when this data is analyzed banks can begin to understand patterns and behaviors and drive profit.

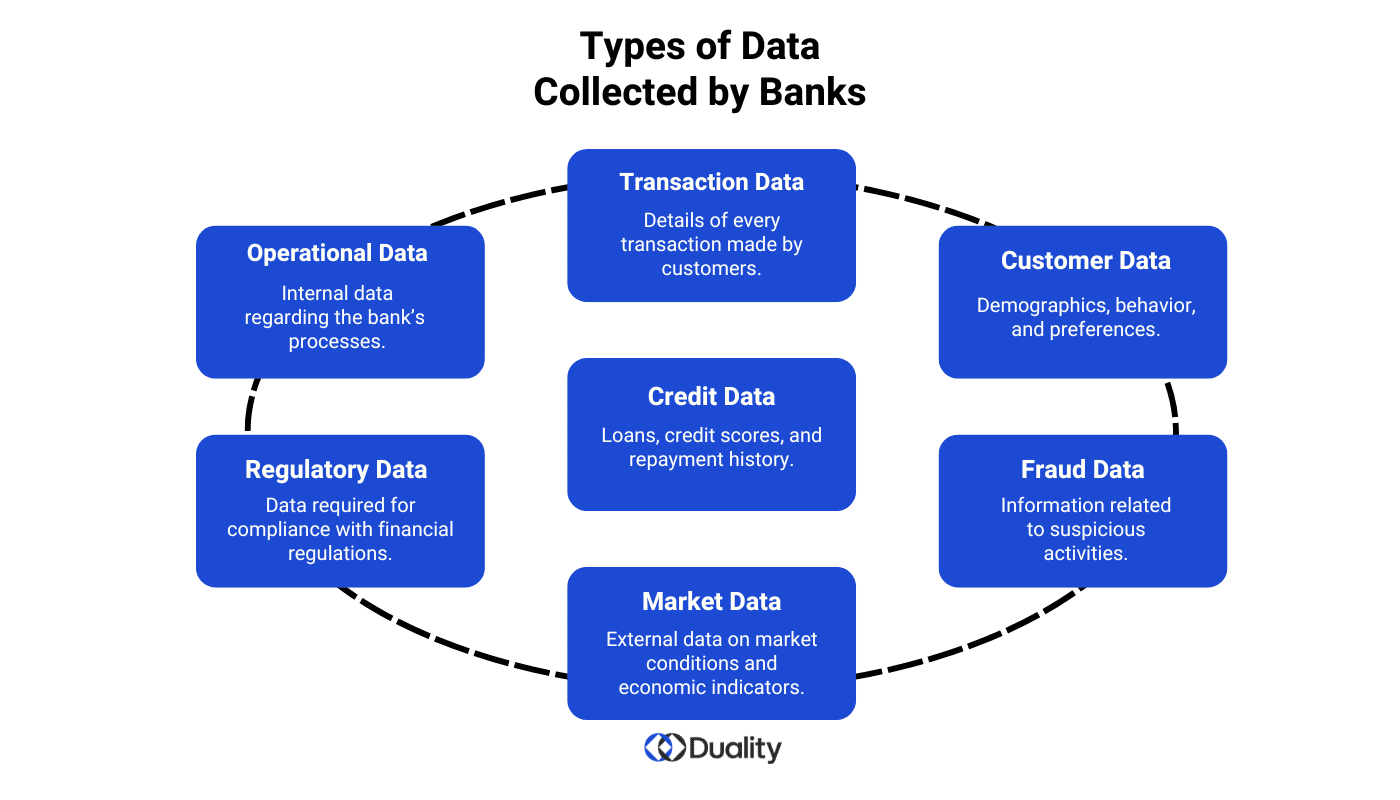

Types of Data Collected by Banks

Banks collect a variety of real-time data that can be utilized for analytics:

- Transaction Data: Details of every transaction made by customers.

- Customer Data: Information about customer demographics, behavior, and preferences.

- Credit Data: Records related to loans, credit scores, and repayment history.

- Fraud Data: Information related to suspicious activities and fraud cases.

- Operational Data: Internal data regarding the bank’s operations and processes.

- Regulatory Data: Data required for compliance with financial regulations.

- Market Data: External data on market conditions and economic indicators.

Value Props of Banking Analytics

When banks use advanced analytics and machine learning to derive actionable insights from their data, they can generate a competitive advantage in the market. And with AI and machine learning constantly learning and adapting, today’s predictions are even more accurate, giving banks more time to respond to varying scenarios. Here’s how banks can use their data to improve operational efficiency:

Fraud Detection

Fraud detection is a key application of big data analytics in banking. Using predictive analytics, banks can identify and prevent fraudulent activities.

- Predictive Models: Banks use machine learning algorithms to analyze historical transaction data and identify patterns indicative of fraud. These models can detect anomalies such as unusual spending patterns or transactions from unexpected locations.

- Real-Time Monitoring: Advanced analytics tools enable banks to monitor transactions in real-time, flagging suspicious activities as they occur.

- Behavioral Analysis: By analyzing customer behavior, banks can identify deviations from normal activity that may indicate fraud. For example, if a customer who typically makes small, local purchases suddenly makes a large international transaction, the system can flag this for further investigation

Customer Relationship Management (CRM)

By personalizing customer interactions and dividing the customer base into groups, banks can create targeted marketing campaigns.

- Demographic Segmentation: Banks analyze demographic data such as age, income, and location to segment customers. This helps tailor marketing efforts to specific groups.

- Behavioral Segmentation: By examining transaction history and spending patterns, banks can segment customers based on their financial behavior. This enables banks to offer relevant products, such as travel insurance to frequent travelers or investment advice to high-net-worth individuals.

Risk Management

Banks use advanced analytics to assess and mitigate various types of risks.

- Credit Risk Assessment: By analyzing a combination of credit scores, transaction data, and other financial indicators, banks can more accurately assess the creditworthiness of loan applicants.

- Market Risk Analysis: Banks use big data to monitor market conditions and predict potential risks. This includes analyzing stock market data, economic indicators, and geopolitical events to make informed investment decisions.

- Operational Risk Management: Big data analytics helps banks identify and mitigate operational risks, such as system failures or compliance breaches.

AI-Powered Chatbots and Virtual Assistants

These tools use artificial intelligence to provide efficient and personalized customer service.

- Customer Support: AI chatbots can handle all types of customer inquiries, from account balance checks to transaction history requests, improving the overall customer experience.

- Financial Services Advice: Virtual assistants can provide personalized financial advice based on a customer’s financial data.

Regulatory Compliance

Adhering to stringent data protection laws is a significant challenge for banks. Regulations such as GDPR and PCI-DSS require banks to implement comprehensive data privacy measures, maintain detailed records, and ensure data security, which can be resource-intensive and complex to manage.

Sell Your Data

Just as banks need AI models to derive meaningful insights from their data, AI developers require extensive datasets to train and refine their models. By selling anonymized data to these developers, banks can create an additional revenue stream. This data is crucial for AI developers to improve the accuracy and performance of their models. In turn, these enhanced models can benefit the banks by optimizing their own operations, leading to better customer service, more accurate predictive analytics, and improved risk management.

How Can Banks Utilize Data Securely

While leveraging AI models to derive insights from data and selling anonymized data to AI developers can significantly enhance operations and business intelligence, these strategies are not without risks.

Fortunately, banks now have a comprehensive, secure, and private means to utilize AI models without exposing their sensitive data to the model provider, and without the provider needing to reveal sensitive aspects of their models to the banks.

Duality’s secure data collaboration platform allows banks and financial institutions to adopt AI models, monetize data, and integrate additional data sources while protecting sensitive information and intellectual property.

Our AI Governance Framework ensures that AI technologies are ethical, transparent, and compliant. It establishes structured principles for explainability, accountability, safety, security, and fairness, creating trust and confidence among users and stakeholders.

By leveraging privacy-enhancing technologies (PETs), Duality safeguards sensitive data while promoting responsible AI innovation.

Ready to turn your banking data into a revenue stream? Contact us today to find out how Duality’s platform can help you unlock the full potential of your data.