Insurance fraud occurs when someone knowingly lies to obtain a benefit or advantage to which they are not otherwise entitled. The impact of insurance fraud affects us all – our economy, our wallets, and our ability to compete for better insurance types and sources. Simply put: when they lose, we lose. So, what is keeping organizations from swiftly adopting newer insurance fraud solutions that can help prevent fraud, mitigate risk and ultimately help eradicate these financial killers?

In this blog, we will look at the most prevalent types of insurance fraud today, how they are not limited to industry or region – and ultimately how innovation can pave the way for new standards and practices in insurance fraud solutions.

Different Types of Insurance Fraud

According to The Insurance Information Institute – which has been a trusted source of data driven insights on insurance and fraud type since 1960 – the most common acts of fraud include inflating claims, misrepresenting facts, filing false claims, and duplicating claims. These instances are not limited to one specific industry; they extend into auto insurance, healthcare, workers’ compensation, and even catastrophe-related fraud schemes.

Auto Insurance Fraud

Auto insurance fraud is a prominent example of insurance fraud resulting in tremendous losses. A recent study by Verisk, a firm that provides data-driven analytic insights and solutions for the insurance and energy industries, found that premium leakage accounts for around $29 billion of losses for insurers annually. Premium leakage is defined as “omitted or misstated underwriting information that leads to inaccurate rates,” and can include many fraudulent practices such as unrecognized drivers, underestimated mileage, and violations and accidents. Each of these subcategories accounts for billions in losses.

Verisk also found that these losses not only affected the insurers, but also affected customers and their premium rates. They estimated that 14% of a customer’s premium directly covers the cost of premium leakage.

Padded claims also cause massive losses for insurance companies. One example of this is adding fake medical procedures to an insurance claim following a car accident. Because insurers provide passengers with up to $50,000 in benefits for any injuries sustained, a hospital could run unnecessary tests or say they performed a medical procedure that never occurred. This was the case in a big auto fraud incident in 2015, which landed the fraudster a 280-year jail sentence.

Healthcare Insurance Fraud

Fraudulent activity is also pervasive in the healthcare insurance industry. The United States federal government and the National Health Care Anti-Fraud Association (NHCAA) estimate that between 3-10% of overall healthcare expenditure is lost due to fraudulent activity.

There are many forms of healthcare fraud. The tactics and methods vary, and may include but are not limited to:

- Billing for services that were not performed

- Upcharging services and medical items

- Filing duplicate claims

- Billing in a fragmented fashion for tests or procedures that are required to be billed together at a reduced cost

- Performing unnecessary services

Worker’s Compensation Fraud

Within worker’s compensation fraud, there are two possibilities for fraudulent behavior. On the employer side, employers can misrepresent their payroll or the type of work carried out by their employees to save money on insurance premiums. Additionally, employers could also apply for coverage under a false name to avoid paying claims and showing bad claim history.

Employees can also be fraudsters here, by overusing medical care or seeking compensation for an employment-related injury that never occurred.

Disaster-Related Property Fraud

In the event of a disaster, there is ample opportunity for a person to file fraudulent damage claims that are either exaggerated or entirely false. For example, one could use homeowners’ insurance to pay for unnecessary repairs or property that was damaged by the fraudster themself. It is extremely difficult to discern these claims from truthful claims.

The Cost of Insurance Fraud

The insurance industry costs mount quickly with the proliferation of fraud in new and different areas of operation. The Coalition Against Insurance Fraud (CAIF) has conducted in-depth estimates of these numbers.

The CAIF has estimated that fraud costs US consumers at least $80 billion each year. They found that workers’ compensation accounts for over a third of these losses.

This loss drives up the price of insurance premiums and ultimately hurts the consumers. The FBI found that this problem could be adding between $400 and $700 to the average US household’s premium costs each year.

Insurance Fraud Prevention is a Global Issue, Not Just a Local Issue

Insurance fraud is not limited to the United States; this issue is pervasive across the globeentire insurance landscape. The internet has become the go-to resource for us to get insured, check our coverage, submit claims, etc., making it a gateway for global fraudsters. Ease of doing business helps us all, but it also is a means for bad actors looking to kick off yet another scam.

The CAIF partnered with IBM and Luxoft to author a report called “Globalization of Insurance Fraud”. In this report, they surveyed financial crime experts across over 30 different countries spanning each of the continents. 56.8% of these experts agree that their locality does not have dedicated resources to deal with the issue of globalized fraud. Countries within the EU were the most likely to have dedicated insurance fraud solutions and resources, while North America was the least likely to have those resources.

Before we can address how to mitigate insurance fraud, let’s examine the regulations associated with it.

Public and Private Sector Responses to Insurance Fraud

Given the scale of this issue, the insurance industry has reached out to governments and other industries to develop procedures together to help detect false claims.

An example of this was the creation of the national fraud academy – a collaboration between the American Property Casualty Insurance Association, the FBI, the National Crime Bureau, and the International Association of Special Investigation Units. This was created to help educate fraud investigators to become better at detecting insurance fraud.

Also, governments have decided to take fraud prevention into their own hands within specific industries. Five states – Florida, Massachusetts, New Jersey, New York, and Rhode Island – have implemented pre-insurance inspections, like Carco inspections, that a customer must go through before purchasing physical damage coverage for vehicles. In these inspections, the customer must submit photos of their car so insurers can see any pre existing damage. The Carco Group estimates that these inspections have uncovered around $1.8 billion in pre-existing damage in New York alone between 2014 and 2018, saving insurers over $100 million in false claims. For every dollar invested in an inspection, $34 is saved in payouts for falsified claims.

Within the healthcare sector, the 2010 Affordable Care Act (ACA) allows the US Department of Health and Human Services to exclude insurance applicants who have lied on their applications from enrolling in Medicare or Medicaid. Also, the Improper Payments Elimination and Recovery Act was instituted to require insurance agencies to conduct audits and develop plans to combat fraud in the future. Data sharing among health insurance companies has further helped combat fraud in this industry by preventing duplicate claims.

Finally, to prevent fraud related to natural disasters, insurance companies have turned to the science of catastrophes. Forensic meteorologists can accurately verify weather conditions at a specific time and location and show whether disaster-related claims are valid or not. These findings are completely legitimate in court cases and have proven extremely useful in countering fraud within this sector.

Innovative Insurance Fraud Solutions

With all types of fraud, it takes a programmatic networked approach to defeat a network – and the same rule applies in the battle to beat insurance fraud. To combat insurance fraud, companies must consider the types of technologies that can expand the volume and types of data at their disposal. Practically speaking, technology must easily integrate into existing data discovery practices and enable insurers to better understand their prospective and existing customers, as well as the trends across the claims landscape in order to establish a clear baseline for checking against suspicious and fraudulent activities.

Artificial Intelligence/Machine Learning

One example of how insurers are beginning to use technology today, is through the use of AI and/or machine learning (ML). We know that insurance data sets are varied, complex and riddled with sensitive information – yet another reason why insurers must not only prioritize digital initiatives, but the technology that supports digitization. ML is designed to analyze data so computers can make predictions and decisions based on the identification of patterns and historical data, and can use data and algorithms to instantly detect potentially abnormal or unexpected activity. This enables insurers to investigate and correctly identify a suspicious applicant, fraudulent claim and/or other findings. Implementing digital technologies, such as ML, allows insurance companies to increase operational efficiency and mitigate the top-of-mind risk of insurance fraud. And like ML, there are a number of technologies that can work together to deliver predictive analytics and investigative learnings to establish fraud and claim legitimacy.

In the insurance industry, advanced technologies are critical for improving operational efficiency, providing excellent customer service, and, ultimately, increasing the bottom line. And like ML, there are a number of technologies that can work together to deliver predictive analytics and investigative learnings to establish fraud and claim legitimacy.

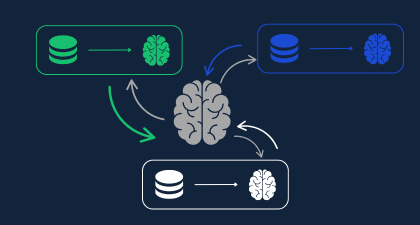

Collaborative Information Sharing

Some technologies also help assess underwriting risk. At the time of quoting, the carrier has only very general information about the customer. Since the customer doesn’t yet hold a policy, some very basic checks are completed on the customer to begin the process of issuing a quote. However, to reduce fraud, many more checks are needed.

Here, technology can play an even more critical role: to gather all of the information on the customer – such as liabilities, job position, income, past instances of fraud, connections to known fraudsters, and more. These data points are all made up of sensitive data, and therefore must be secured and kept private. Once this information has been collected, different carriers can collaborate with one another to better detect fraud, and ultimately arm one another with critical data needed to decide whether to accept or reject a policy applicant.

New Technology, New Collaborations: Guiding Principles and Paradigms for Insurance Fraud Solutions in 2023

If carriers begin to widely adopt the practices and advanced technologies that allow for greater collaboration to increase the pool of data available for cross-checking, the threat of insurance fraud will be much less prevalent. Some current initiatives are working to mitigate more common types of insurance fraud – but what’s missing is the privacy piece.

Privacy-preserving insurance fraud solutions solve the usability/confidentiality issues at play by:

- Enabling data sharing at scale

- Securing data at scale

- Providing the proper support for sharing data across organizations

- Improving fraud detection processes

- Increasing customer trust in onboarding and approval processes

- Creating new opportunities to cross-reference the right data in the event of suspicious activity.

All of these benefits, individually and together, chip away at the vast risks facing insurance agencies today – and make companies’ portfolios healthier in the face of potential fraudsters.

Learn more about how Privacy Enhancing Technologies like Homomorphic Encryption are being used to fight insurance fraud in our webinar: Homomorphic Encryption in Insurance.