In our conversations with customers, partners and industry experts, we see that one big area in need of data collaboration is the fight against duplicate invoice financing, also known as trade finance fraud. In the banking industry, this is a scenario where a business gets a purchase order for the production of goods, let’s say ‘10,000 widgets’ but doesn’t have the capital on hand needed to fulfill the order, so they engage a bank and ask them to finance the order. But what happens if they take the same invoice to multiple banks to be financed?

The process of trade financing is still very much paper-based and there is only very rudimentary technology in place to deal with this issue. The current technology allows banks to ask other banks extremely simple questions like: “Have you seen this invoice or an invoice with a similar amount from this customer?” If someone comes back and says yes, it only tells you that the customer has attempted to finance the invoice already, not whether it has actually been financed. Thus, it’s up to the financial institution to decide whether to take the risk. Financial institutions need the ability to ask more questions of other banks to get more concrete information about their customers and ferry out duplicate invoice financing requests.

Right now, one of the challenges to solving the duplicate trade finance problem is that banks are hindered by regulation within their own country. Bank A is prohibited from asking Bank B if they have relations with a specific customer. Once you start dealing with banks across borders it becomes even more complicated because citizen data cannot leave the country due to regulations. A final challenge is that trade financing relationships are long-standing. Financial institutions do not want to jeopardize their relationships with their customers by asking another bank if they have any dealings with that customer (which will reveal the relationship).

How does Duality help address these issues with duplicate trade finance and duplicate invoices?

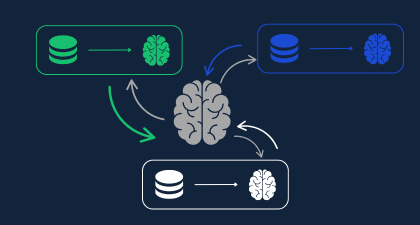

Duality can deal with all of these issues without exposing any customer or bank data. With the Duality platform, which leverages multiple privacy enhancing technologies, no sensitive information is ever revealed nor does it leave the data center where the data is located. Since no data actually moves, organizations can use this technology in a way that is compliant with regulations like GDPR. Not only is it compliant with the regulation, but because the question the bank asks and the answer the corresponding banks provide is encrypted, regulators have stated that when using our technology the data is actually outside of the purview of regulation. This addresses trade residency requirements, ensures compliance with regulation and as a result, will help solve duplicate invoice financing.

Do you hear objections from banks about adopting the Duality solution?

The question used to be, “will this technology work?” but that is no longer the issue. Most technology and security leaders in large financial institutions have recognized that this privacy preserving data collaboration technology is valid and keeps data protected.

Also, people will ask, does regulation allow this type of collaboration? That’s a question that’s best answered on a case-by-case basis, but based on regulatory and legal opinion the answer is most often yes. Our capabilities for allowing banks to share encrypted insights, instead of directly sharing personal data, are invaluable for financial institutions looking to mitigate compliance risks.