Sanctions have been a top news item for the last few months. In this blog, let’s examine what sanctions are, the history of sanctions, and how technological advancements can enable institutions to improve sanction discovery and actioning, simplify data collaboration, and expedite their ability to respond to sanction mandates. However, before we dive into how to address sanctions with technology, let’s first understand the history of sanctions.

A Brief History of Sanctions

The term “sanctions” has been thrown around quite a bit over the past two decades. For those of us not familiar with the specifics, economic sanctions include commercial and financial penalties levied against individuals, companies, and/or countries, typically for political purposes.

Pre-1900s

Sanctions date back to ancient times. In 432 BC, the Athenian Empire enacted the earliest recorded form of sanctions by banning traders from Megara from its marketplaces; the move eventually led to the dwindling of Megara’s economy.

Other early sanctions include the Continental System, Napoleon’s blockade against the British during the Napoleonic Wars; the US Embargo Act of 1807, in which Thomas Jefferson’s administration banned foreign trade with Britain and France to discourage impressment of American soldiers; and numerous blockades and embargoes between the North and South during the American Civil War.

Sanctions in the Globalization Era

However, for the most part, sanctions have become a modern tool of the post-WWI era; inherently linked to globalization. As Nicholas Mulder, author of The Economic Weapon: The Rise of Sanctions as a Tool of Modern War (Yale University Press) states, the elements needed for sanctions are “globalization, the administrative state, and mass society.” This is due, in part, to the way modern sanctions are levied: by the US Office of Foreign Assets Control (OFAC), a subdepartment of the US Department of the Treasury, which issues specific lists determining against whom sanctions are filed and to what extent. Financial institutions, globally, must cross-reference these lists every time they onboard a new client, whether business or individual.

Since World War I, sanctions have been levied countless times; the most well known examples include the US embargo against Cuba (1958), the Organization of Arab Petroleum Exporting Countries (OAPEC)’s 1973-74 ban on oil sales to the US and other Western countries (causing the 1973 oil crisis), and the United Nations embargo against apartheid South Africa (1987). More recent examples include ongoing sanctions against Iran, North Korea, and Syria.

Do Sanctions Work?

Are sanctions effective? It depends on whom you ask. According to one 2015 study, US and UN economic sanctions reduce the GDP growth of targeted countries by an average of 3% per year, with long-lasting effects for 10 years; this culminates in an average aggregate decline of the target country’s GDP per-capita of 25.5%. In 2019, the U.S. Government Accountability Office (GAO) published a report entitled Economic Sanctions: Agencies Assess Impacts on Targets, and Studies Suggest Several Factors Contribute to Sanctions’ Effectiveness which explicitly states that measuring the direct impact of sanctions on foreign policy is difficult, but also posits that their effectiveness overall is boosted when a) carried out through a formal body such as the United Nations Security Council (UNSC) or b) when the targeted entity is dependent on the US.

On the other hand, experts have cited in multiple studies that sanctions not only have a negative impact on the economy, public health, and security of the targeted country, but on the economic status of the body imposing the sanctions as well. More importantly, historically, it is unclear whether sanctions actually work in the long-term: as a 1998 Brookings article notes, sanctions against Iran since the 1970s have failed to produce their regime from supporting terror movements; sanctions against Saddam Hussein failed to persuade him to withdraw from Kuwait in 1990, leading to Operation Desert Storm; sanctions against Cuba failed to unseat Fidel Castro; the list goes on. Indeed, extrapolating from the historical trend, North Korea continues to test nuclear weapons, despite being sanctioned since 2006 – and Syria continues to be in the throes of a civil war, despite sanctions against the Syrian government being levied in 2010.

Sanctions in the Digital Age

Whether or not sanctions work long-term, enforcing them produces special challenges in the digital age. Today, sanctioned individuals can easily open shell companies to facilitate money laundering, fraud, and effectively dodge their impact by exploiting financial institutions’ inability to share vast information regarding the full expanse of their holdings with other institutions.

In the US, most major banks can only see 25% of their customers’ data and history; in Canada, that number is 15%, and in the UK, as low as 10%. Moreover, networks of sanctioned individuals or institutions are larger than ever before – and the threat of malicious insiders being able to tip off sanctioned individuals that they are being flagged is high. Sanction-dodgers are skilled at exploiting this lack of visibility, and know how to hide their digital breadcrumb trail. In the current conflict, some are even using data privacy laws as a legal shield to defend their activities.

The Technological (un)Divide

The sanctions discovery process needs an overhaul – now more than ever. According to Deloitte, “operating costs spent on compliance have increased by over 60 percent for retail and corporate banks.” And with the proliferation of data privacy regulations in general and in the financial space in particular increasing, the most cost-effective way to handle these complex processes is by wielding AI and other advanced technologies in the market. Using privacy-preserving technologies will revolutionize the future of how institutions handle financial crime; standardizing that technology will smoothen processes further.

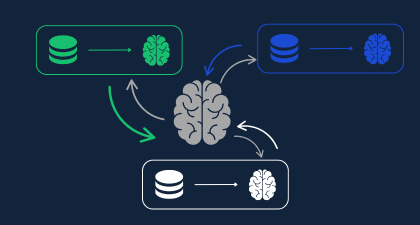

Privacy-Enhancing Technologies are one way to reform the process and bring it into the digital transformation age. When applied correctly by cryptographic experts, PETs allow financial institutions to:

- Collaborate with other financial institutions, law enforcement, and data conglomerates to gain a fuller understanding of prospective customers’ transaction history

- Discreetly query the financial behavior of individuals or companies during the onboarding process – keeping the identity of the individual being queried about a secret from all parties except for the inquirer

- Create, tune, and train models to alert compliance officials of suspicious transactions or behavior

For more information about how Privacy-Enhancing Technologies are being used to fight financial crime, check out this interview below with Neil Ringwood, Executive Consultant, IBM Global Business Services.

Stay tuned for Part II of this blog, where we delve into the technological impact on the evolution and history of sanctions.