KYC compliance isn’t just challenging—it’s fragmented. Duality transforms Know Your Customer compliance by enabling secure, encrypted data collaboration across branches, divisions, and even external entities. Achieve compliance without compromise.

the problem

Financial institutions, especially banks, must verify customer’s identity, monitor risk, and comply with evolving KYC regulations, all while safeguarding customer data. Traditional KYC procedures involve sharing raw customer information between departments or with third parties, exposing banks to significant risks of data breaches and regulatory penalties. Additionally, manual and fragmented workflows slow down operations, making customer onboarding and risk monitoring inefficient and costly.

the solution

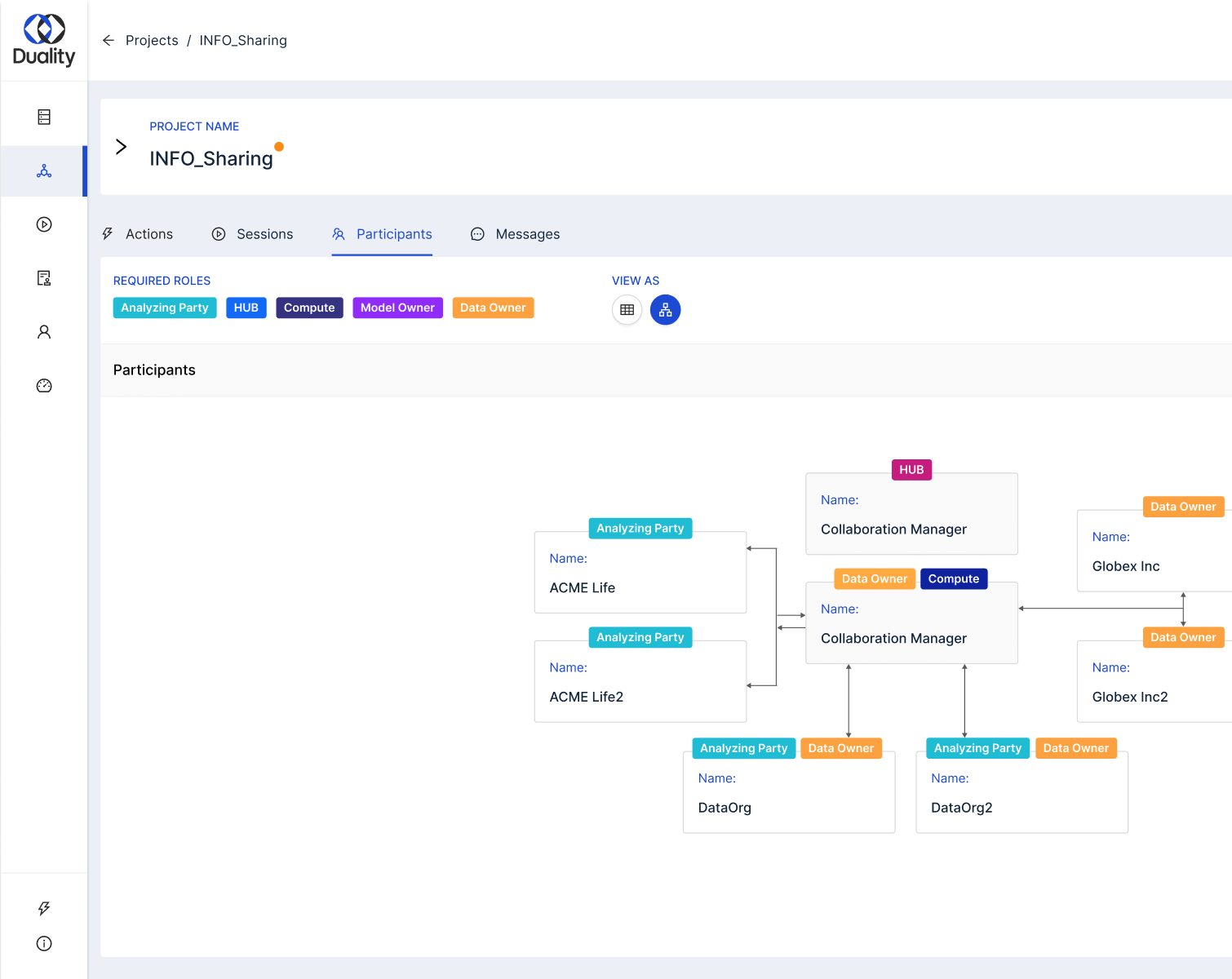

Using techniques such as homomorphic encryption and secure multi-party computation, Duality enables banks to analyze and share encrypted data without ever exposing its raw form. This approach ensures banks can safely centralize and analyze fragmented customer information across divisions and with external partners while staying compliant with global regulations. Customer privacy is maintained while allowing banks to facilitate risk assessment and fraud protection.

“We partnered with Duality to fulfill the promise of privacy preservation in information sharing. The Duality platform has the potential to become one of the key tools for inter-bank collaborations.”

Securely share customer data between financial institutions, branches, and third-party entities for comprehensive identity verification.

Analyze encrypted data to identify fraudulent patterns and assess potential risks without exposing sensitive information.

Speed up the customer onboarding process by securely accessing and analyzing third-party data sources while remaining compliant with data protection laws.

Detect and prevent money laundering, identity theft, terrorist financing, and other financial crimes.

Safely share data across departments, institutions, or regions to strengthen KYC measures.

Streamline your KYC processes, reduce manual effort, and onboard customers faster to reduce operational costs.

Stay ahead of global data protection and regulatory requirements, including GDPR and CCPA.

Keep data encrypted throughout its lifecycle, even during analysis.

By enabling privacy-preserving collaboration across data silos, our platform simplifies due diligence, background checks, fraud detection, and anti-money laundering efforts.

Transform KYC from a resource-intensive process into a secure, efficient, and compliant system.

Duality’s advanced technology, including fully homomorphic encryption (FHE) and machine learning, allows you to analyze sensitive data without ever exposing it. Stay ahead of regulatory changes, protect customer identities, and ensure secure, seamless collaboration within your organization and beyond.

Duality enables banks to verify identities, assess risks, and meet KYC regulations—all while keeping sensitive customer data encrypted and protected.