How Lenders Can Leverage Technology to Mitigate Duplicate Trade Fraud

Trade finance fraud is not new and has been surfacing in headlines more and more in recent years. Some of this may be related to the post-Covid demand on the supply chain. However, others believe that it has more to do with the number of high-profile banks moving away from the funding trade due to the growth in fraud that has been plaguing this business which historically offered banks a significant return on their investment.

Before we can explore how technology can assist in providing a defensive, preemptive posture and how standardization can impact the future of trade fraud financing, we need to understand what has changed and examine the different aspects of trade fraud.

In July 2020, a livemint.com headline read: “After $9 billion credit hit, banks seek trade finance overhaul.” This scam not only left more than 23 banks on the hook for $3.5 billion dollars, and put the perpetrator, Hin Leong Trading Pte. – one of Singapore’s biggest oil traders at the time – on the road to collapse.

This story marks the day the banking world took notice of the anti-fraud gaps within trade financing – gaps that still exist today and are pushing financials to adopt better practices and new technologies. In fact, over the past few months, we have made it our mission to understand firsthand from financial institutions why this gap still exists. Some have stated that it’s easier to step away from trade financing as a business model entirely versus risking the cost of trade financing fraud or even the cost of fraud prevention.

Now, let’s examine one type of trade financing fraud known as duplicate trade financing. Whereas traditional fraud is the intentional deception to secure unfair and unlawful gain, duplicate trade financing fraud is the act of premeditatively seeking financing from multiple sources to fund the same invoice, purchase order, accounts receivable, etc., multiple times. While there are a number of reasons why duplicate trade financing fraud plagues reputable and noteworthy financial institutions, most include the struggle to implement a sufficient defensive posture – due to antiquated processes and behaviors, lack of standardization, and limitations on how technology can help preempt and mitigate risk.

Bad actors take advantage of these communication breakdowns to exploit financial institutions. In fact, most lenders have their own unique data systems and do not share customer data across borders or with other lenders – easily enabling bad actors to secure duplicate financing from multiple financial institutions for the same order. This was the case with Hin Leong Trading PTE, who shopped around financing for a $76.5 million dollar fuel purchase to multiple banks including HSBC and Credit Agricole, who eventually funded the fuel purchase, only to fall victim to a duplicate financing scam, along with 21 other financial institutions. The banks that were hardest hit each lost at least $400m-$600m, just from this one organization.

As technology continues to advance and regulations being introduced that empower organizations to do more with sensitive data – – financial institutions are still not strategically leaning on modern IT to close the gap on trade financing fraud.

There are many challenges that arise for financial institutions in developing a strategy to detect and prevent trade financing fraud.

These challenges are not limited to but include:

Privacy Regulation differs by country and ultimately is one of the most critical aspects of carrying out a collaborative data sharing strategy. Cross-institution and cross-border collaboration can only occur while maintaining regulatory compliance, and technology must account for this.

Competitive Concerns or protecting one’s intellectual property (IP) is also a critical factor when enabling collaboration. Banks have their own competitive landscape; they want to ensure that customer retention – and, ultimately, capitalization – is not impacted by giving too much of their data away.

Financial Regulations which impact the trade financing process are measures which aim to stabilize and protect the financial system as a whole, as well as protect consumers of financial services. These regulations can cover financial crimes, such as money laundering and fraud, and can also address banking secrecy rules which (in some jurisdictions) forbid financial institutions from revealing certain business relationships. These regulations present their own set ofchallenges in finding the balance between protecting data privacy and regulatory compliance.

Cross-bank and Cross-border data sharing refers to the ability or agreement to share sensitive data with other financial institutions either in a country, region or across borders to conduct discovery on potential bad actors or fraudsters who are shopping their financing options around. As was in the case that we referred to earlier, that unwittingly propagated into a series of duplicate trade finance scandals that led to more than $9 billion in losses for global lenders.

Opportunities abound to earn revenue by establishing better safeguards and leveraging technology to implement a trade finance revamp. However, there are several challenges in the adoption of modern IT, as it requires knowledge, expert guidance, and the ability to leverage any technological investments over time – with the understanding that an investment today should also support the goals of tomorrow. Three key areas to consider when establishing a strategic shift in technology that will enable organizations to collaborate in combating fraud threats while ensuring privacy is preserved are: encryption types, approaches, and technologies; data collaboration platform adoption vs. adoption of a single privacy enhancing technology; and the impact of data modeling and AI.

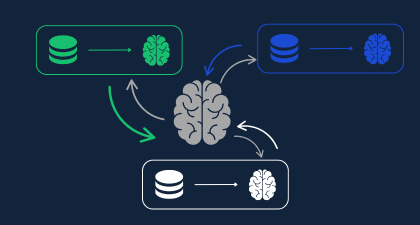

Privacy Enhancing Technologies (PETs) vs. Platform, the PETs landscape consists of several different types of privacy enhancing technologies that are used to preserve, encrypt, and contend with sensitive data while ensuring shareability.

The most common PETs used by financials vary based on need:

This is in addition to, or in place of, other measures that financial institutions have started to leverage to address the trade financing fraud challenge:

It is our recommendation that you identify the situations where data privacy is paramount, determine how data needs to be shared, and understand what exactly needs to be protected. Then you can determine what PET or combination of PETs might be appropriate. No one PET is always foolproof, and it’s critical for financial services organizations to conduct a review of whether PETs are already being implemented or not, what PETs exist across the data sources and organizations they are looking to collaborate with, and from there establish the right combination of PET(s) to achieve the goals. This scenario is very similar to the more traditional security threats of the past: it’s not enough to intercept a single point of vulnerability with a single product; rather, one must think more broadly about infrastructure and the many different aspects of fraud prevention.

Once you have defined your PET landscape and the criteria list required in a solution that will support your data collaboration objectives, it’s time to weigh the benefits of adding data modeling and AI to your strategy.

By definition, data modeling is the process used to define and analyze data requirements needed to support the business processes within the scope of corresponding information systems in organizations. Therefore, the process of data modeling involves leveraging professionals with deep roots in data science and working closely with business stakeholders as well as potential users of the information system. And while data modeling falls into three distinct categories or types – conceptual, logical, and physical – we recommend that financial institutions focus on the techniques and methodologies that enable data sharing to be standardized with predictable and actionable outcomes. Working closely with a trusted advisor that helps establish models to support privacy preserving data collaboration enables financial institutions to establish a dependable, preemptive strategy to tackle fraud and mitigate risk.

Erick Brethenoux, a Gartner Analyst, published an article this past March, What Is Artificial Intelligence? Ignore the Hype; Here’s Where to Start, where he challenges data and analytics leaders to “demystify AI” by removing the technology jargon and focusing the conversation on solving real business problems with achievable use cases. First, Brethenoux speaks my language, which may sound interesting knowing that I’m responsible for the marketing practice at Duality – and we all know that marketing is synonymous with catchy jargon. However, supporting the goals of technology today must be less about “marketing hyperbole” (how Erick refers to it) and more about the actuality of solving critical problems. When it comes to fraud, we all pay in the end as it has a global impact; therefore, when it comes to preventing it, we all win.

So how does AI impact data modeling, or more specifically financial fraud? From the fraud perspective this would fall into what Gartner refers to in their AI Techniques Framework as predictive modeling, a method of predicting future outcomes by using data modeling. Financial institutions must first embrace data collaboration, then apply AI to their data modeling strategy, advancing their analysis and logic-based techniques – including machine learning to interpret events, support and automate decisions, and drive actionable outcomes.

Identifying the data sources, data types, geographic footprint, PETs, and goals are all part of the discovery checklist that any financial institution which is looking to solve a fraud problem holistically must adhere to – and what our organization helps financials solve. Our economy is exceedingly global, our dependency on all things digital continues to grow, and fraud is easier to pull off if we don’t solicit and unleash the power of our data.

In conclusion, Howard Zinn said it best, “We don’t have to engage in grand, heroic actions to participate in the process of change. Small acts, when multiplied by millions of people, can transform the world.” Financial institutions can take small steps first, such as kicking off an intra-banking (cross-border or cross-team) collaboration project, then shift to working with other financial institutions to leverage each other’s data in a regulatory compliant manner. The adoption of modern IT, data science and cryptography enables a more advanced approach to data sharing and collaboration which ensures that privacy is preserved, complex data sharing and multisource data is possible to use – and, ultimately, that financials have a proven strategy that they can lean on to mitigate risks, account for bad characters and behaviors, and unleash the value of the data they are already collecting.

Learn more about trade finance with Duality and how you can help drive change and contribute to the evolution of financial standards for privacy preserving data collaboration.